One of the most important financial tools available to Canadians for tax and retirement planning is the Registered Retirement Savings Plan (RRSP). In fact, if you don’t own a business, it is one of the very few ways in Canada to legally shelter or defer tax. On a smaller scale (because of limits) we also have the use of a Tax Free Savings Account (TFSA).

Clients frequently have questions about both. How do they work? What is the difference between an RRSP and a TFSA? Why would I choose one over the other?

Imagine that an RRSP and a TFSA are like sheds out back behind your house. A place to store stuff and keep it sheltered from the elements. Just like in your garden shed or garage, you can have lots of “stuff” stored that you need, depending on the season. Sure you could just store all that stuff under a tarp in the corner of the yard, but inevitably it is going to get wet and dirty, likely rusting or wearing out sooner than it otherwise might. Instead we try to store as much as possible in a garage or “shed”.

In the case of investments, we want to shelter your investments from the rain, snow and sleet of taxation.

The “stuff” we store in your shed is called “qualified investments”. The most common are: Cash, GICs, mutual funds, bonds, preferred shares, real estate income trusts and stocks. There are others that also meet the definition, but are less common or more complicated. For the sake of our discussion we’ll stick to the common ones listed above.

The benefit of owning these investments in a registered account is we get to shelter investment income (interest, dividends, capital gains) from tax. RRSPs have the added benefit of contributions (deposits) being before tax. Let’s explain.

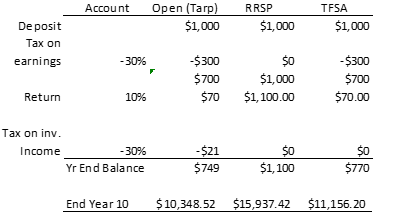

The average tax rate in Canada is about 30%. There are different tax rates applied to different types of income, but for our example we are assuming all investment income is taxed at 30%. As just mentioned, it is a very important factor that RRSP contributions are before tax; meaning you do not pay tax on those earnings, and the whole amount goes into your RRSP. If you’ve already paid tax on those earnings (through your employer) you get tax back when you file your tax return in the spring. However, contributions to a TFSA are after tax.

If you earn and contribute $1000 to an RRSP, you invest $1000. If you earn $1000 and contribute to a TFSA, you only have $700 to invest (you paid, or owe 30% tax). The same applies to an Open (or non-registered) account; investments, stored under the tarp, are after tax). Over time this makes a big difference!

So after one year (assuming a fictional 10% rate of return for easy math), the difference between an Open, RRSP and the TFSA can be significant; $749 in an Open account, $1100 in an RRSP and $770 in a TFSA. The longer the period of time, the bigger the difference.

Notice that at 30% tax rate, there isn’t much difference between an Open (your backyard tarp), and the TFSA account.

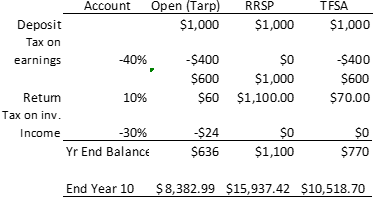

The higher your marginal tax rate, the bigger the difference.

While every case is different, you likely want to save for the long term utilizing an RRSP first, TFSA second and a regular old Open (non-registered – sometimes called “cash”) account only for the “stuff” that doesn’t fit into the other two sheds. Especially if your marginal tax rate is 40% or higher.

There is another significant difference between the accounts though! When you begin drawing on your RRSP in retirement, or after you convert to a Registered Retirement Income Fund (RRIF – another explanation for another day), the proceeds are considered income and taxed at your marginal rate at that time. Withdrawals from a TFSA are tax free! Hence the name. (Speaking of names, it should really be called a Tax Free Investment Account). Also in favour of the TFSA, while you’ve paid tax on your interest and dividend earnings in the Open account as you went along, there may be unrealized capital gains that are taxable as you draw down on your investments inside the Open account, attracting tax when investments are sold.

Usually, due to reduced income levels and tax credits, you pay a lower tax rate in retirement than you did in your working years. Even if withdrawals are at the same marginal rate as your previous contributions, you are not going to be worse off by utilizing an RRSP. If your marginal tax rate is lower during withdrawals, then you have legally avoided tax.

The higher your tax rate, the more likely you’ll want to prioritize RRSP savings first, but consult with a Certified Financial Planner Professional for guidance customized to your circumstances. Which shed is right for you, at what time in your life, based on what and when you want the money?

RRSP and TFSA accounts are just places to store your stuff in order to minimize and defer tax. How and when you use them will depend on your unique needs, but unless you’re happy storing your prized John Deere riding mower out under that tarp all winter, you likely want to utilize one, or both, of the two sheds available to you.