While you can choose to RRIF sooner, and you should talk to your Certified Financial Planner Professional if this applies to you, most clients put off converting their RRSP accounts into RRIF accounts until they have to; age 71. The date used to be age 69.

Before December 31st of the year in which you turn 71, you have one of three choices for your registered accounts (all registered savings accounts, including RRSP, LIRA, Spousal RRSP etc…):

- Collapse the Registered Retirement Savings Plan (RRSP) and all monies become taxable income in that calendar year

- Buy a registered annuity with the proceeds, or

- Convert to a Registered Retirement Income Fund (RRIF)

Almost everyone, in this low interest rate era, chooses #3. The first is not very tax efficient and the second isn’t always appealing (but that is a different discussion entirely).

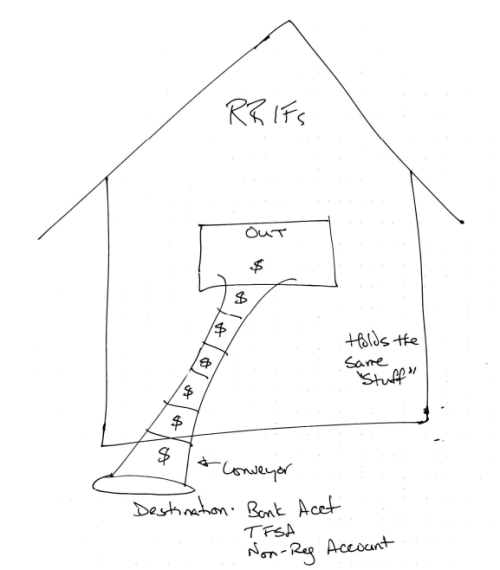

Both RRSP and RRIF accounts are “registered” – that is what the first R stands for. Basically, shelters from tax: RRSP for savings; RRIF for income. The only real difference between the two is literally and figuratively the third letter. “S” for savings and “I” for income. You can own exactly the same type of investments (“stuff”) in a RRIF account as you can in an RRSP account. The only difference is the requirement to create income after the RRIF is funded instead of saving.

Here’s an analogy I often use. An RRSP is just a shed you own that shelters your stuff (in this case money, not a lawnmower) from the diluting rain of taxation. This shed has a spring-loaded trap door that snaps back closed to discourage you from taking the money back out again. Sure you can take steps to take the hinges off the door and reach in to scoop money out. It will cost you though – in the form of Income tax. Any withdrawal becomes taxable income this year. An RRSP is really designed to be a safekeeping place for money until you need it in the future. In retirement; what the second R stands for!

The RRIF shed on the other hand looks exactly the same as the RRSP shed. It is the same shape and size and serves the same purpose; to shelter your retirement savings from tax. There is only one key difference. Instead of a trap door, the RRIF shed has a conveyor belt running out of it. That conveyor gets turned on and runs at a minimum speed annually, starting no later than December 31st of the year you turn 72. With the exception of a Life Income Fund (LIF), you can speed the conveyor up to take more out, but there will always be a minimum speed (amount) you have to withdraw based on your age. (https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/completing-slips-summaries/t4rsp-t4rif-information-returns/payments/chart-prescribed-factors.html).

So, before the end of the year, you have to build a RRIF shed, right beside the RRSP shed. Using a not-so-secret underground tunnel (CRA knows all about it.), you move the “stuff” from the RRSP shed to the new RRIF shed. Voila. Done. That simple.

You can choose to make withdrawals from the RRIF annually, semi-annually, quarterly or monthly. You can take it as cash to your bank account, or you can transfer the investments “in-kind” to another investment account like your TFSA. But, you have to withdraw at least the minimum amount annually and count that as income on your tax return next April.

It is simply a transfer from one “shed” to another.

Enjoy. You’ve worked hard for it.